"Who do you work for?"

I get that a lot. Instead of giving a roundabout, hard to explain answer, I usually just say

"I'm retired".

Then follows the automatic "you look awfully young to be retired" and then the inevitable

"I wish I could do that".

This got me thinking about the experience Laura and I have had over the last several years, and my general outlook long before then.

It's meant for people about our age (mid 50's and older) who have kids that have moved out.

And maybe it's for the younger crowd, just starting out. If they re-imagined their eventual retirement - as I'm sure most of them are doing anyway - much of this makes sense for them too.

You Have Enough

Over the last fifteen years, as I started to think about eventually quitting work, I found myself challenging the accepted belief that you needed a huge chunk of money* to retire. It seemed however much you had, it was never going to be enough.

For me, and most people I know, the days of a defined benefit pension program were long gone. What you had accumulated needed to last until you were dead. Nobody was going to send you a regular paycheque once you stopped reporting for work.

There are entire banking sectors set up to tell you how much you'll need based on your anticipated lifestyle.

As it turned out, Laura and I were forced into this predicament by my health issues. I can't ever see a time where full-time work is a real option for me anymore. And when we look closer at it, neither of us can see a time when full-time work is required (or desired) for either of us.

So we are forced into this "early retirement" with less than we thought we needed. And I'm increasingly convinced that it is, indeed, enough.

What it needs is a change of attitude, and a real in-depth look at what's truly important to you.

What's Important

The lesson we've learned over the last eight years (2006 kicked this process off**) is that life doesn't really care how much you plan. Events will conspire to kick you in the teeth when you least expect it. The more flexible you are, the more willing you are to try new things, and the more you're able to put preconceived notions of "

this is how it must be" on the back burner, the better equipped you'll be moving forward.

It's best to start with a challenge to many of the preconceptions you probably have.

- Everyone needs to own a house. Think of all the money you have tied up in a house - money that could be working for you elsewhere. How much do you pay in property tax? Insurance? Maintenance? Self esteem? 60% of people in Germany never own a house, and never plan to. Why is that? We now rent a one bedroom basement suite.

- Everyone needs at least two cars. Really? And how often in one of them sitting at home? What if you just managed your time better? What if both of you didn't work full time? We got rid of my truck, and we now drive Laura's much more fuel efficient car.

- Everyone needs lots of room for their stuff. Why do you have so much stuff? If you had a fire today, and you could take just one thing before getting out of the house, what would it be? I guess I'd say "the dog".

- We need two incomes to manage this lifestyle. So change the lifestyle. Determine what you "need" versus what you "want".

I've been anal about tracking our spending since we first got married. And I'm surprised to report that our social lifestyle hasn't really changed at all, but the cost of that lifestyle is half to one third of what it was. No more buying something because you're bored, or eating out three nights a week because you're tired.

The Strategy

Here are the steps we've taken, and so far - so good.

- Sell your house. Hopefully, if you're in Canada at least, the house is worth more than the mortgage on it. Take the proceeds from the house and invest it wisely (be conservative - this money has to last!).

- Sell your stuff. You're going to be moving into a much smaller place, so decide what you really need. You can't have it all - and as we've discovered - your kids likely don't want anything of yours anyway. If you need to rent some storage space, go ahead. But have some time limit to when everything in there is cleaned out.

- Sell your car. I'd like to get rid of the cars altogether, but based on where we live, one is kind of essential. If we lived downtown, I'd likely aim for a shared-car service.

- Pay off your debt. You should plan on having ZERO debt. Pay off credit cards every month. Have a zero balance on the line of credit. Owe nobody.

- Move. Rent a small one or two bedroom place. What this buys you is freedom. Don't like your neighbors - move. Don't like the price of rent - move. Don't like the city - move. Much easier to be flexible as a renter than as an owner.

- Think part time. Supplement your investment income with small, part-time jobs. We try deliberately to avoid a full time commitment (short term, full time is OK - like a maternity leave).

- Know where you're at. Become fanatical about your financial position. Know when things are going well, and when they require some tweaking (ie: line up more work).

- Adjust your lifestyle. Live on less. Go to movies on cheap night (around here, Tuesday). Eat at home almost all the time. Our "big night out" is on Thursday with friends, where we meet up for sushi. Costs us about $25/week.

What these changes have afforded us is ultimate flexibility. Want to go to away for a week next month? Go. Want to go away for a month next week? Go. Want to live back in Calgary for a year? Go. Want to visit the Maritimes for a couple of months this fall. Go.

And as I mentioned earlier - our social life is better than before. And we travel three or four times as much.

We're fortunate in that I think we have enough. The number will be different for everybody, but I'm pretty certain that it's significantly less than what you think.

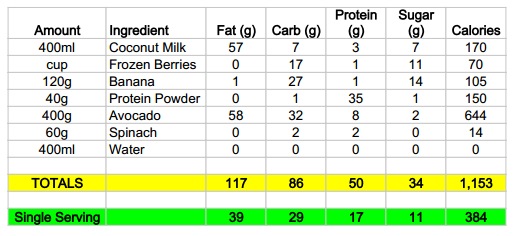

Our lifestyle today runs about $3500/month, with about $1000/month of this set aside for vacations. When we add up the part-time jobs we have along with the investment income, we're doing quite nicely.

The Benefits

There are a few subtle benefits that seem obvious to me now.

- By leaving full time employment, you actually free up a job for a younger person. Someone who likely needs the paycheque a whole lot more than you do. A big problem in our economy now is that there's no mobility for younger workers - all because we refuse to leave!

- You eat much better at home when you have time to cook and plan meals. It costs much, much less, and you eat much, much healthier.

- You get rid of all that "mental overhead" of managing too many tasks in not enough time. This includes mortgages, doctor appointments, oil changes, lawn-moving, fence fixing, everything...

- You have the time and the energy to regularly exercise. Regularly as in "just about every day".

So enough of "I wish I could do that".

You probably can. Because you probably have enough.

* Some say $900K, some say $1.5M, some say $5M - who really knows?

** Major "kick you in the teeth" life events that have happened to us:

2006 - Jack Beauchamp, my cousin's husband, was murdered

2006 - I asked for a 6 month leave of absence from work.

2006 - Days before leaving on the LOA, discovered that I needed heart bypass surgery.

2007 - Returned to work.

2009 - Took a buy-out at work. Planned on travelling for a year, and then getting another job.

2009 - 4 weeks after leaving, had a relatively major stroke. Relearned how to walk and talk.

2010 - Laura goes back to school for Early Childhood Education - we are sure to need the income.

2011 - I've got some part time work through a friend that keeps me in spending money

2011 - Laura is really enjoying her new career, but she has to be careful about accepting full time jobs!